Fast-Tracking Vehicle Insurance with Multi-Agent Systems

Introduction

Vehicle Insurance has long been known for its complexity. Why? Because it relies on the seamless coordination of multiple parties such as car owners, claim handlers, adjusters, approvers, and insurance providers. These parties are working within a process that’s often slow and heavily manual.

Here’s how it typically goes: the car owner first connects with an insurance agent or company to purchase a policy. This requires completing a detailed application covering vehicle’s information and the owner’s driving history. Once approved, the policy outlines the coverage, premiums, and terms.

When an accident occurs, the car owner must file a claim with the insurance company. They need to provide all necessary documentation, such as photos of the damage, police reports, and repair estimates. A claim handler steps in to review and may physically inspect the vehicle. Depending on the findings and policy conditions, the claim is either approved or denied. If approved, an adjuster determines the compensation amount, and the insurer disburses payment to the vehicle owner or repair shop.

Sound time-consuming? It is—and each stage brings its own share of challenges.

What are the biggest roadblocks in today’s claims process?

- Lengthy timelines due to multi-step, multi-party coordination

- Heavy reliance on documents like accident photos, police reports, and repair bills

- Delays in claim approvals, often triggered by inconsistent information

- Frequent breakdowns in communication between stakeholders

- High chances of disputes around damage assessments and claim validity

- Minimal automation—manual intervention dominates the workflow

- Inaccurate or inconsistent data capture

This begs the question: Is there a way to fast-track insurance claims while improving accuracy, minimizing disputes, and reducing manual effort?

Time-intensive analysis of historical claim data

Multimodal Gen AI models

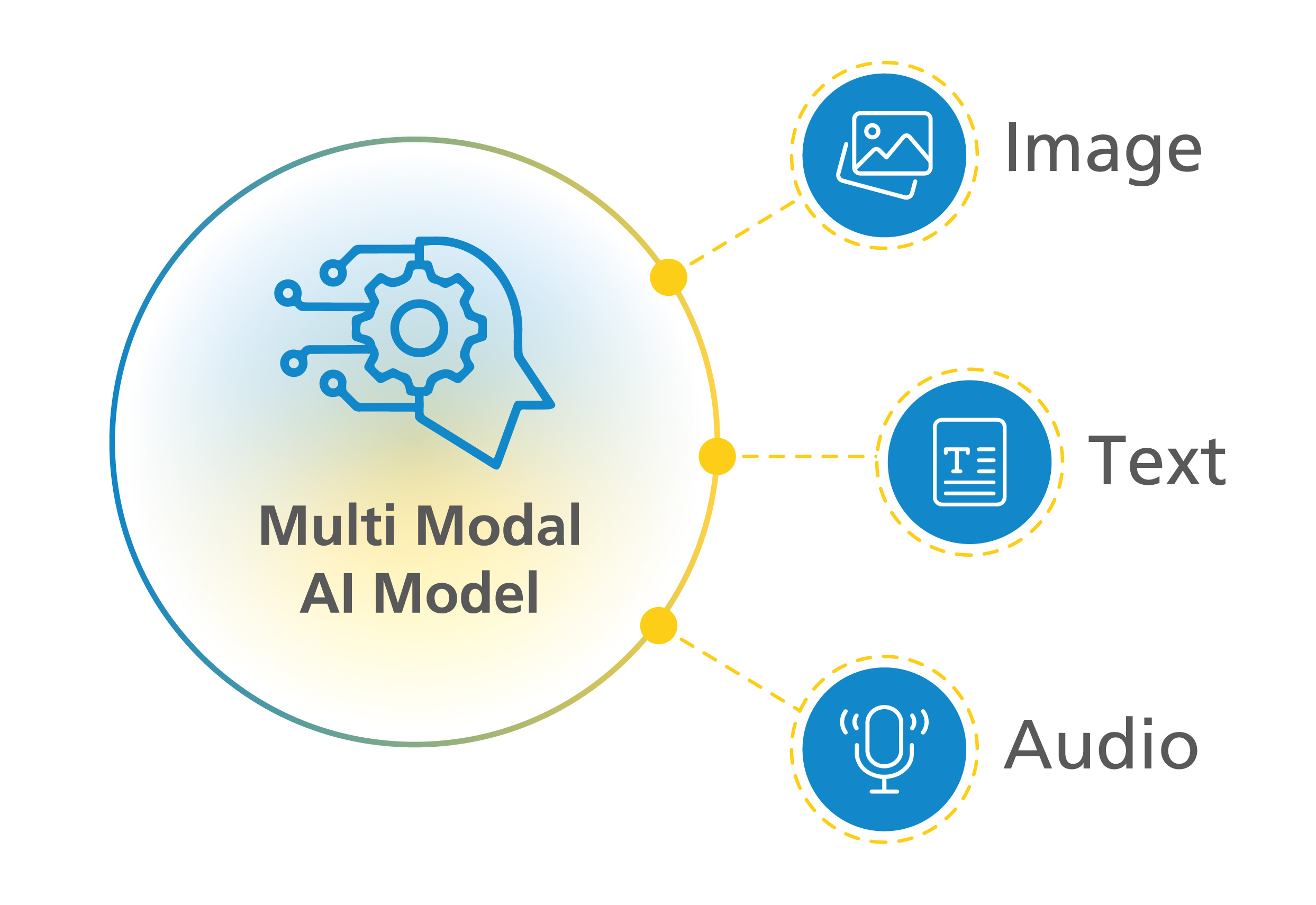

A multimodal model is a type of machine learning system that can process information from various modalities, such as images, videos, and text together.

Figure 1:Multi-Modal LLM

Let’s say an accident image is submitted during a claim. A multimodal large language model (LLM) can analyze the photo and accompanying text to identify the damaged part and evaluate how severe the damage is. It mimics the human decision-making process by interpreting context from multiple data sources simultaneously.

How traditional RAG systems help—but only to a point

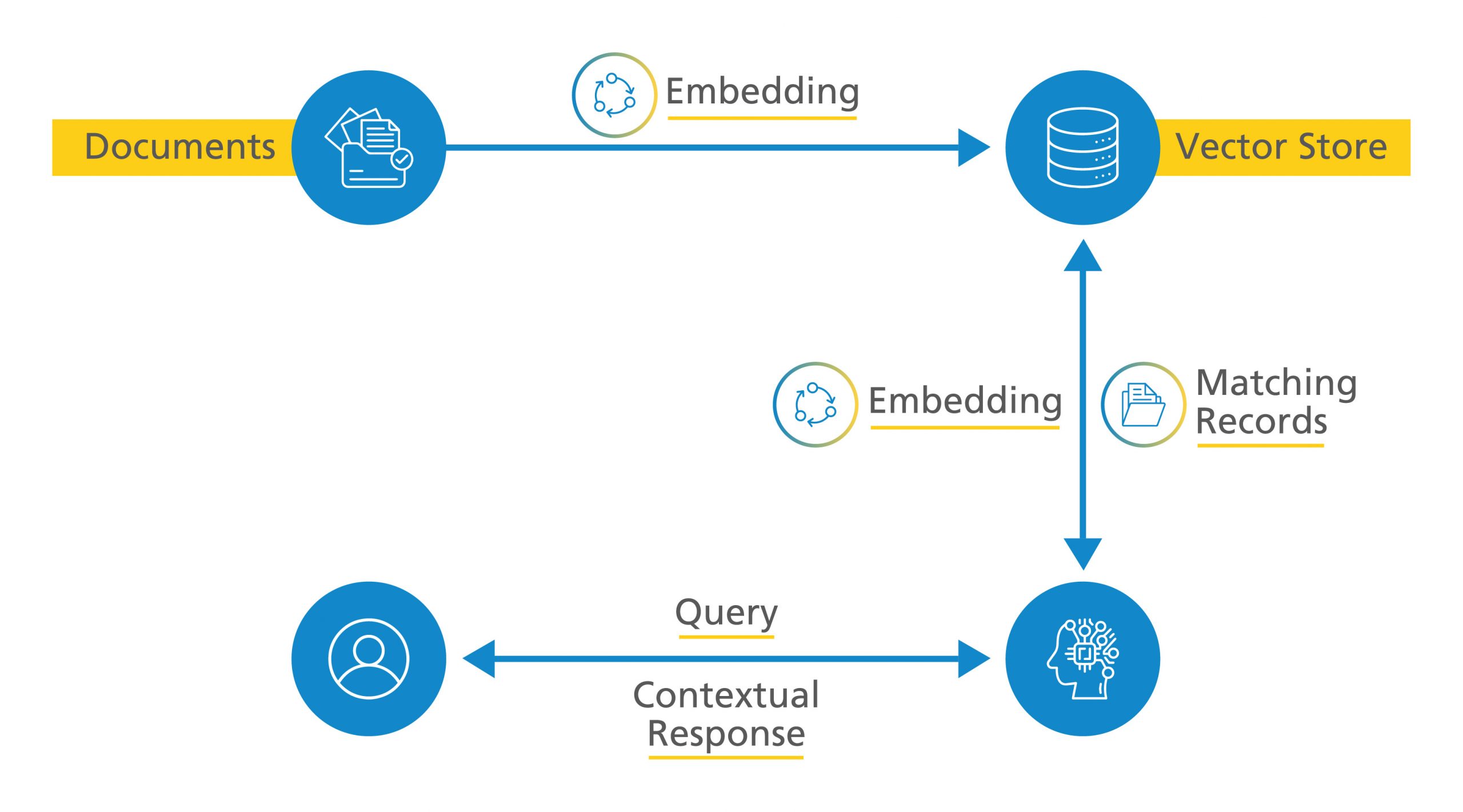

Figure 2: Traditional RAG System

Retrieval-Augmented Generation (RAG) systems are designed to enhance LLMs by providing access to a knowledge base. Here’s how they work: the system converts textual data into numerical formats using embedding models and stores them in a vector database. When a user inputs a query, the system searches for the most contextually similar information and presents a relevant, grounded answer.

This system offers solid support, but on its own, it lacks the ability to dynamically collaborate across multiple specialized tasks. That’s where agent-based systems come in.

Multimodal-powered multi-agentic System with RAG Capabilities

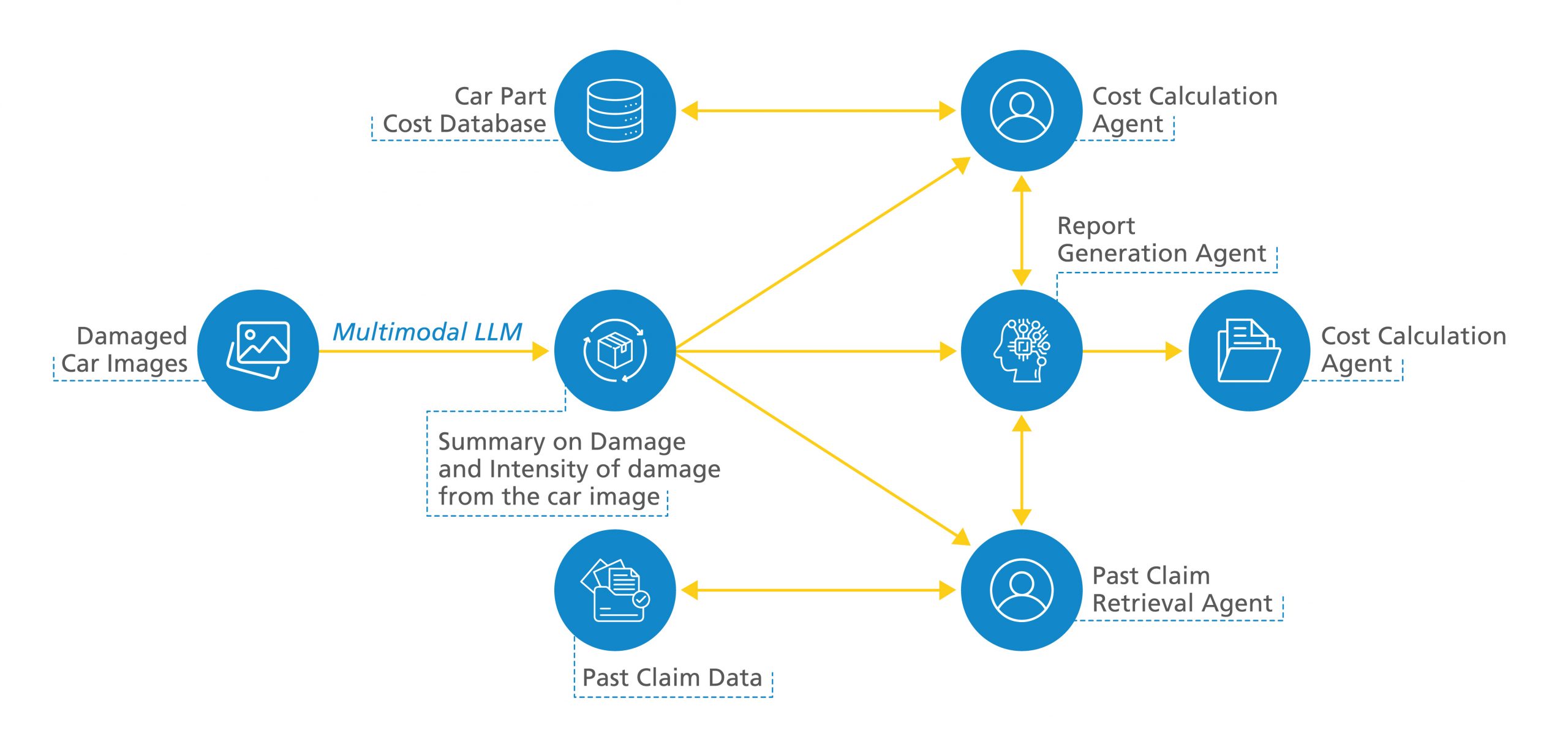

Imagine a virtual team of agents—each trained to handle a specific function—working together to support your claims process from end to end. That’s the idea behind a multi-agentic system, integrated with a multimodal RAG system.

Our agentic architecture is made up of four key :

- Multimodal LLM

- Cost calculation agent

- Past claim retriever agent

- Final report generation agent

Together, these components automate most of the heavy lifting in claim approvals.

Figure 3: Agentic Claim Management System

Multi-modal LLM: Seeing what a human would

This agent examines multiple accident images and combines them with written accident details to generate a damage summary. Think of it like a human claim handler interpreting the visuals and writing a report—but in seconds. It determines which parts need repair versus replacement and provides a structured text summary of damage intensity and location.

Cost calculation agent: Mapping damage to expenses

Once the damage summary is available, this agent steps in with pricing intelligence. It calculates the total cost by considering the car’s make and model and matching the required parts and repair work against a dynamic pricing database. This distinction between repair and replacement is crucial, especially for complex vehicle builds.

Past claim retriever agent: Learning from history

Wondering if a similar claim has been processed before? This agent answers that question by pulling historical claims with similar damage patterns, cost implications, or accident details. The ability to reference past claims helps claim approvers validate assessments quickly and make informed decisions.

Final report generation agent: Pulling it all together

All the insights such as damage summaries, cost breakdowns, similar past cases, vehicle and user profile details are compiled into a final report. This report is tailored for the claim approver and includes only the most relevant, actionable data needed for decision-making.

So, what are the advantages of using multi-agentic systems in insurance?

- Automated data extraction: Speeds up insurance processing by retrieving document information without manual input

- Accurate damage assessment: Uses computer vision to interpret accident images, reducing dependency on human inspections

- Predictive analysis: Helps in early fraud detection and streamlines claim approvals using machine learning insights

- Efficient text analysis: Processes claim narratives, accident descriptions, and reports quickly through natural language processing

- Reduced administrative burden: Reduces human effort, minimizes errors, and improves team productivity

- Improved customer satisfaction: Faster resolutions, fewer disputes, and more transparent processes lead to higher satisfaction

- Enhanced transparency: Every stakeholder gets access to relevant data at the right time, reducing back-and-forth

Conclusion

The integration of advanced technologies like multimodal large language models and agent-based systems is reshaping how insurers handle claims. By automating data extraction, assessment, and decision-making, these tools significantly reduce manual effort while increasing accuracy and transparency across the board.

More importantly, they serve a dual purpose: speeding up approvals and strengthening fraud detection With machine learning analyzing patterns and anomalies across claims, insurers are better equipped to flag suspicious activity early, before it becomes a liability.

This shift doesn’t just make the process more efficient; it makes it smarter. Policyholders experience quicker resolutions, fewer delays, and greater clarity, key drivers of customer satisfaction in today’s fast-moving insurance landscape.

References

1 Multimodal AI, Google Cloud: https://cloud.google.com/use-cases/multimodal-ai?hl=en

2 LangGraph: Multi-Agent Workflows, LangChain, January 23, 2024: https://blog.langchain.dev/langgraph-multi-agent-workflows/

3 Build a Retrieval Augmented Generation (RAG) App: Part 1, LangChain: https://python.langchain.com/docs/tutorials/rag/

4 Build a Retrieval Augmented Generation (RAG) App: Part 2, LangChain: https://python.langchain.com/docs/tutorials/qa_chat_history/

Latest Blogs

Introduction There is a lot of noise around Agentic AI right now. Every headline seems to…

Traditionally operations used to be about keeping the lights on. Today, it is about enabling…

Generative AI (Gen AI) is driving a monumental transformation in the automotive manufacturing…

Organizations are seeking ways to modernize data pipelines for better scalability, compliance,…