Reimagining Claims for the AI-Driven Future

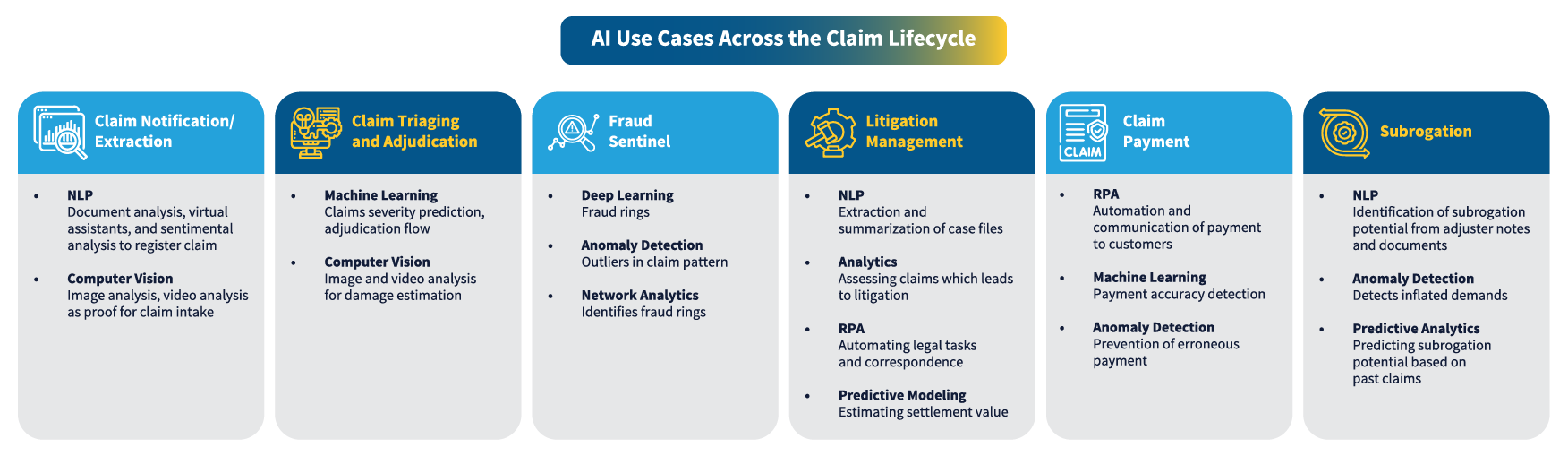

Claims are the insurer’s “moment of truth.” In 2025, the frontier shifted from simple digitization to intelligent, human-guided automation. This paper explores how generative and agentic AI are transforming the entire claims journey from intake and triage to fraud detection, litigation, payment, and subrogation. As AI in claims management gains momentum, insurers are rethinking traditional workflows and embracing Intelligent Claims Automation as a foundation for future-ready operations.

Key technologies include natural language processing (NLP) and document intelligence for fast, accurate First Notice of Loss (FNOL); computer vision and predictive models for one-touch decisions; and graph analytics for proactive fraud detection.

We also describe operating models that integrate AI into core platforms through dynamic workflows, role-based dashboards, and human-in-the-loop override paths to balance automation with informed human judgment. These models serve as the backbone of modern Intelligent Claims Automation, enabling scalable and compliant adoption of AI-led capabilities.