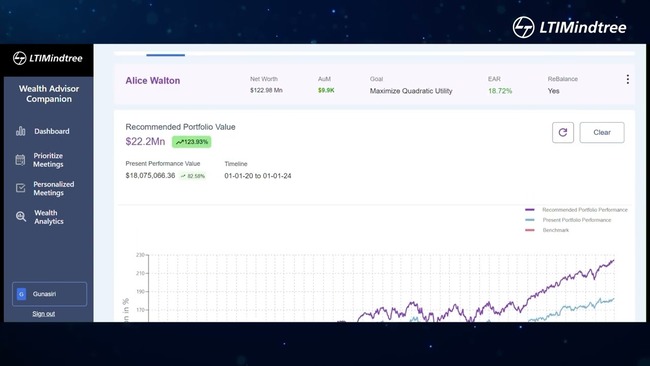

Reimagining Wealth Management with BlueVerse Wealth Companion

LTIMindtree’s BlueVerseTM Wealth Companion is a robust, AI-powered, and quantum-integrated platform designed to transform the wealth management industry. It empowers wealth managers and financial advisors to deliver smarter, faster, and more personalized services such as real-time portfolio analysis, investment report generation, and proactive rebalancing strategies. By harnessing generative AI, quantum annealing, and advanced wealth management analytics, BlueVerse Wealth Companion enables advisors to make data-driven decisions with precision, significantly boosting their productivity and enhancing client meeting preparation and prioritization.