Key Performance Indicators

ON A SUSTAINED POSITIVE

TRAJECTORY

In FY25, we experienced steady revenue growth, driven by strong

demand for our AI and digital transformation services. Despite facing

margin pressures, we remain well-positioned for sustained success,

with positive momentum in business development.

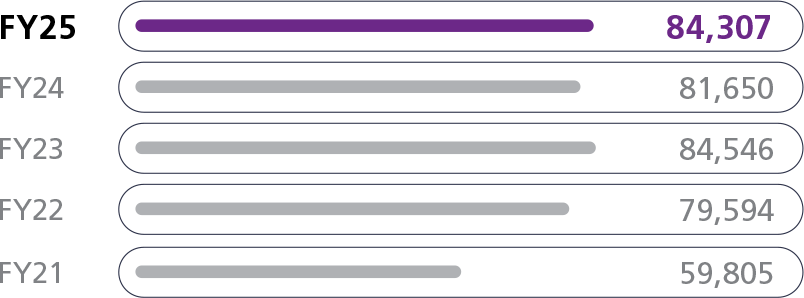

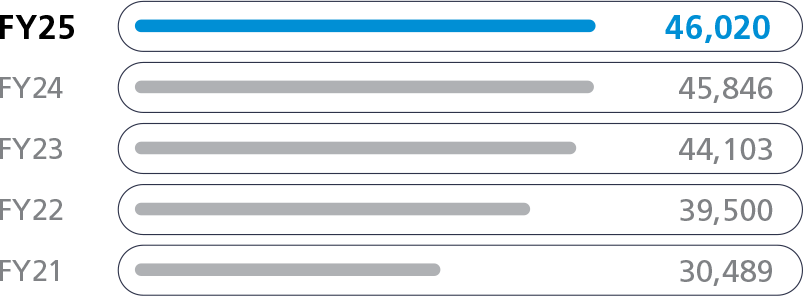

Net Worth

0

18.2% CAGR

(INR in Million)

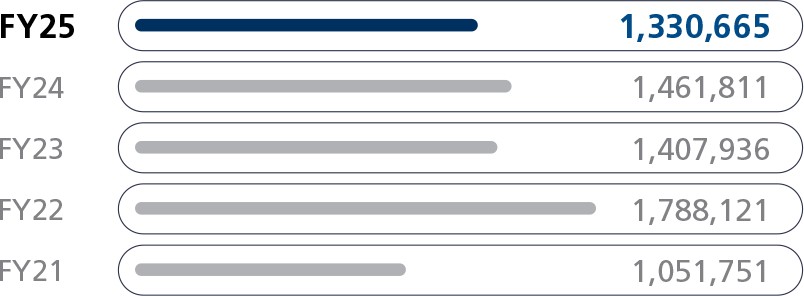

Market Capitalization

0

6.1% CAGR

(INR in Million)

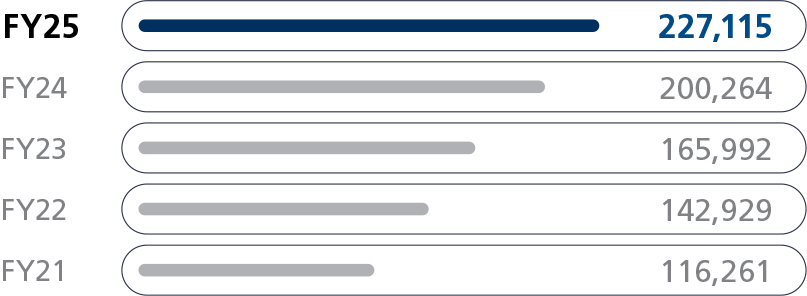

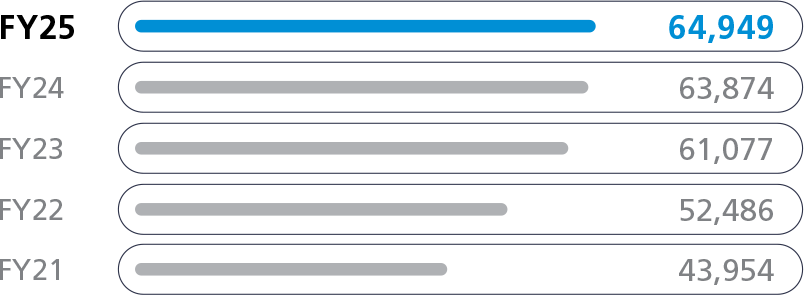

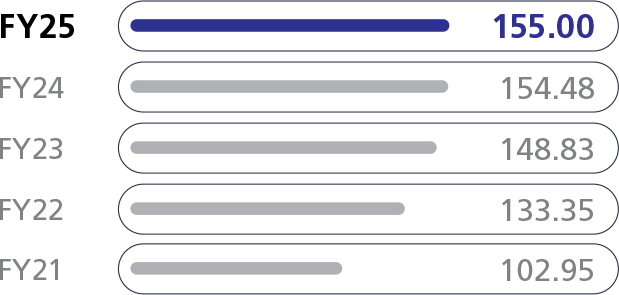

Revenue

0

16.9% CAGR

(INR in Million)

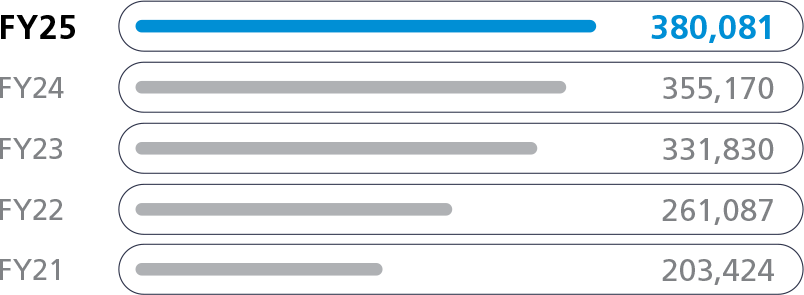

EBITDA

0

10.3% CAGR

(INR in Million)

Profit After Tax

0

10.8% CAGR

(INR in Million)

CSR Spend

0

(INR in Million)

EPS (Basic)

0

10.7% CAGR

(INR)

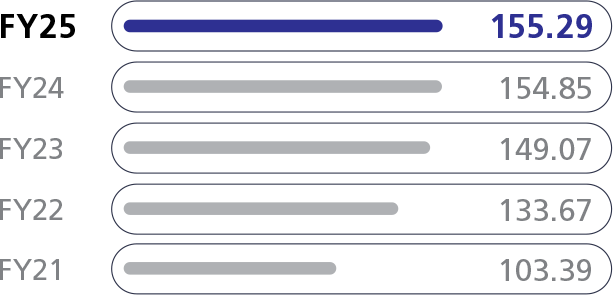

EPS (Diluted)

0

10.8% CAGR

(INR)

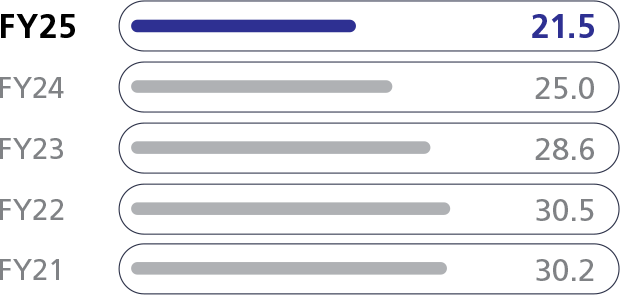

Return on Equity

0

(in %)

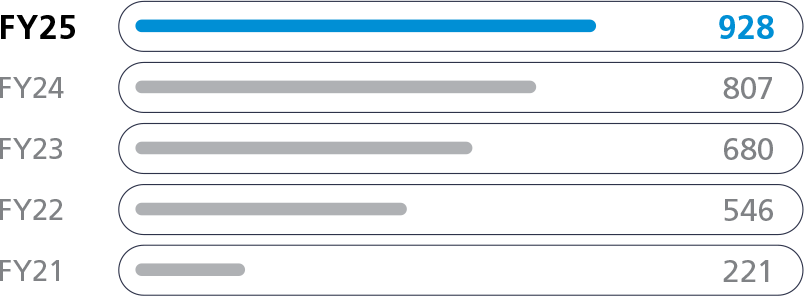

Dividend Paid

0

23.8% CAGR

(INR in Million)

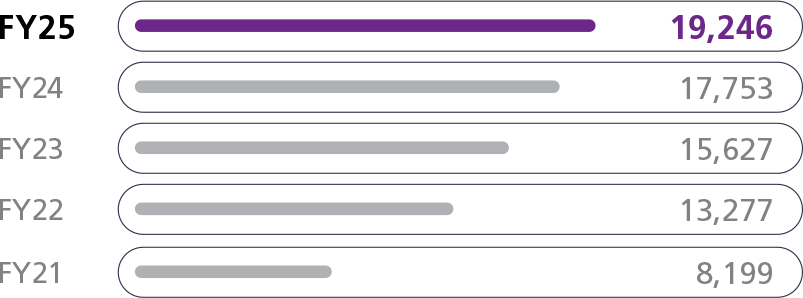

No. of Employees

0