Management

Discussion

and Analysis

728

Active clients

USD 4.1 Billion

Revenue

84,000+

Employees across the globe

35

Countries worldwide

Global

Global GDP growth has been slowing in the face of reduced investment, and elevated inflation and interest rates, along with disruptions caused by the Russia-Ukraine conflict. There has been rapid monetary policy tightening around the world to contain inflation. In many countries, inflation has also been spurred by sharp currency depreciations relative to USD, as well as tight labor market conditions. As the global conditions make it more difficult to service debt, concerns about debt sustainability in many countries have also risen. In the United States, one of the most aggressive monetary policy tightening cycles in recent history is expected to slow growth sharply. The Euro area had to contend with severe energy supply disruptions and price hikes, in addition to inflation. Growth of emerging economies is anticipated to remain mostly unchanged in 2023 relative to 2022, as a pickup in China could offset the decline in other emerging economies. Concerns about financial vulnerabilities are in focus, including in financial institutions, housing markets, and low-income countries. While headline inflation has started declining, it remains elevated and could persist longer.

However, a key factor in improving activity and sentiment in early 2023 was the decline in energy and food prices. The earlier-than-expected re-opening in China is also expected to have a positive impact on global activity, reducing supply chain pressures, and giving a boost to international tourism. The decline in energy prices partly reflects the impact of a warm winter in Europe, which helped preserve gas storage levels and reduce energy consumption in many countries. Goods inflation has started declining in most countries, due to the gradual return of normal demand for goods in the post-pandemic scenario and the easing of global supply chain bottlenecks.

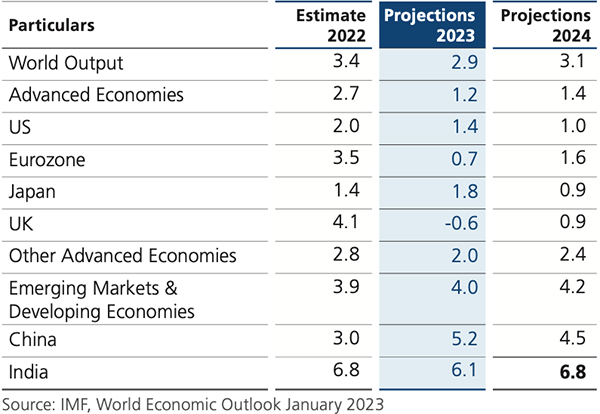

International Monetary Fund (IMF) global growth forecast, as of Jan 2023 (% change year on year)

Global growth is projected to slow from 3.4% in 2022 to 2.9% in 2023. The low growth forecast for 2023 reflects the rise in central bank rates to fight inflation especially in advanced economies, along with the Russia-Ukraine conflict.

The United States is expected to experience a decline in growth from 2.0% in 2022 to 1.4% in 2023 and 1.0% in 2024, with growth rebounding in the second half of 2024. There is a 0.4% upward revision for annual growth in 2023, but a 0.2% downward revision of growth in 2024 due to the steeper trajectory of Federal Reserve rate hikes. Consumer spending rose in January 2023, along with real disposable income and manufacturing activity. However, core inflation, housing inflation, and food inflation remained high.

European economic growth was more robust than anticipated, partly due to government support for households and businesses affected by the energy crisis and reopening of the economies. European gas benchmark price fell below its pre-war level, due to a milder-than-expected winter, a sharp fall in gas consumption, and the continued diversification of supply sources. Labor markets remained tight, with unemployment in the EU staying at its all-time low of 6.1% in December 2022.

The United Kingdom in 2023 is projected to see negative growth, with the economy performing worse than other advanced economies, including Russia. This would be largely due to tightened fiscal and monetary policies, financial conditions, as well as rising mortgage costs, increased taxes and persistent worker shortages.

Growth projections for emerging market and developing economies show a modest increase from 3.9% in 2022 to 4.0% in 2023, and to 4.2% in 2024. Half of the emerging market and developing economies are expected to see lower growth in 2023 compared to 2022. Emerging and developing Asia’s growth is expected to rise in 2023 and 2024, while growth in emerging and developing Europe is likely to have bottomed out in 2022. Latin America and the Caribbean’s growth is projected to decline in 2023, and the Middle East and Central Asia’s growth is projected to decline mainly due to a slowdown in Saudi Arabia. Meanwhile, sub-Saharan Africa’s growth is projected to remain moderate at 3.8% in 2023, with Nigeria’s growth rising due to measures to address insecurity issues in the oil sector.

Global growth is expected to slow to 2.9% in 2023, before rising to 3.1% in 2024, with inflation falling from 8.8% in 2022 to 6.6% in 2023 and 4.3% in 2024. The global economy is witnessing continued turbulence with fresh headwinds from the banking sector turmoil in some advanced economies. The sudden announcement of an output cut by OPEC+ in April 2023 and the resultant jump in crude oil prices is yet another evidence of volatility. Uncertainty about the course of the Russia-Ukraine conflict, coupled with its broader consequences, is also a key concern. As geopolitical tensions remain elevated, businesses are increasingly looking to make their supply chains more resilient by moving production home or to stable countries. The overall outlook thus remains dynamic and fast evolving.

India

The First Advance Estimates (FAE) released by the National Statistical Office (NSO) place India’s real Gross Domestic Product (GDP) growth at 7.0% for FY23. These optimistic growth forecast stems, in part, from the resilience of the Indian economy seen in the rebound of private consumption seamlessly replacing the export stimuli as the leading driver of growth. The uptick in private consumption also provided a boost to production activity, resulting in an increase in capacity utilization across sectors. The rebound in contact-intensive sectors and discretionary spending is expected to support urban consumption.

The Union Budget for FY24 sought to complement macroeconomic growth with a focus on all-inclusive welfare, promoting digital economy and fintech, technology-enabled development, energy transition and climate action, and kickstarting a virtuous private investment cycle, crowded in by public capital investment.

Fundamentals and medium-to-long-term prospects remain stable for Indian equities, but, in the near term, they face possible headwinds from oil prices, inflation, interest rates, and fund flows. The ongoing domestic demand revival story remains a key pillar of strength. The expectation of a record rabi harvest bodes well for the easing of food price pressures, while there are early indications of softening wheat prices, helped by supply-side interventions from the government. The impact of recent unseasonal rains in some parts of the country, however, needs to be monitored.

Strong credit growth, resilient financial markets, and the government’s continued capital spending and infrastructure push have created a conducive environment for investment. India’s recovery from the pandemic was relatively quick, and future growth is likely to be supported by solid domestic demand and a pickup in capital investment.

For the IT industry, FY23 was a year of continued revenue growth, with a focus on strengthening industry fundamentals and building on trust and competencies. The volatile global economic environment and impending recession continue to support the demand for technology adoption and digital acceleration. Technology, thus, remains a strategic imperative–a critical component of business innovation and transformation, as well as a source of improving operational and cost efficiencies.

India’s technology industry has exhibited continued revenue growth and is estimated to have grown by double digits in constant currency terms in FY23. India’s technology industry revenue is estimated to have crossed USD 245 Billion (8.4% year on year growth), an addition of USD 19 Billion over FY22.

USD 500 Billion

Projected Revenue of IT Industry by 2030

According to NASSCOM, the sector is on track to hit USD 500 Billion in revenue by 2030. The share of digital tech in overall technology services revenue has been on the rise-from 26-28% in FY20 to 32-34% in FY23. The industry continues to be a net hirer, adding 2.9 Lakh new jobs and taking the total employee base to approximately 5.4 Million (5.7% year on year growth), strengthening India’s position as the ‘Digital Talent Nation’ for the world. Further, the sector remains on the top globally in terms of AI skills penetration with a 36% digitally skilled workforce, the second largest in terms of AI/ML BDA talent pool, and the third largest in terms of installed supply of Cloud professionals.

References

- Inflation Peaking amid Low Growth (imf.org)

- OECD Economic Outlook, Interim Report March 2023

- Global Economic Prospects, January 2023, World Bank

- OBR Economic and fiscal outlook, March 2023

- Europe Economic Forecast, Winter 2023, February 2023

- Governor’s statement, RBI, April 2023

- State of the Economy 2022-23: Recovery Complete

- India Union Budget, 2023

- RBI Monetary Policy Statement – 2022-23

- NASSCOM Strategic Review 2023: The Technology Sector in India

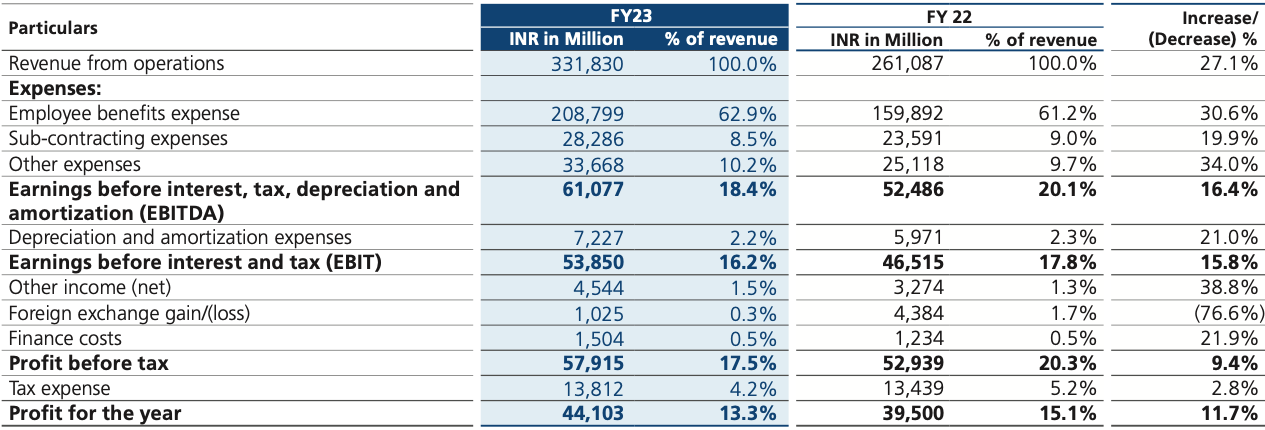

For FY23, LTIMindtree’s USD revenue stood at USD 4,106 Million, up 19.9% in constant currency and 17.2% in USD terms, and INR revenue stood at INR 331,830 Million, up 27.1%. PAT margin came in at 13.3%, compared to 15.1% for FY22. Excluding the one-off impact of merger-related integration cost, our EBIT and PAT margins were approximately 40 and 30 basis points higher, respectively. LTIMindtree’s financial performance is a testament to the unwavering commitment of its team and increased ability to deliver across larger, more significant transformation requirements.

LTIMindtree has built a strong ecosystem of partners that enables it to drive significant value for its clients in an ever-changing technology landscape. With the merger of erstwhile LTI and erstwhile Mindtree, our partner ecosystem has become even more robust.

In FY23, LTIMindtree significantly deepened its engagement with partners by investing in scaling capacity, co-creating joint offerings, building Centers of Excellence (CoEs), and signing up exclusive partner programs to accelerate business momentum in key focus areas such as Cloud, Data, Security, and Customer Experience, among others.

We also launched two state-of-the-art innovation centers in collaboration with AWS and ServiceNow.

- LTIMindtree ServiceNow Innovation and Experience Center - Hartford

- LTIMindtree AWS Innovation Center - Hartford

LTIMindtree has a 360-degree relationship with many of its strategic partners. This enables the Company to have a resolute focus on achieving joint business outcomes and creating exponential business growth. We have attained the highest tier of partnership with a number of its strategic partners including Microsoft, AWS, IBM, Google Cloud, Salesforce, SAP, Oracle, Cisco, Snowflake, and Adobe.

Recognitions

In FY23, LTIMindtree received multiple awards from various partners in recognition of its outstanding performance and contribution toward building joint businesses:

- Emerging Service Provider Americas 2023 by ServiceNow

- Migration Partner of the Year 2022 – NAMER by AWS

- Global Collaboration Partner of the Year 2022 by AWS

- Global Delivery Platform Partner of the year award 2022 by Snowflake

- Emerging Partner of the Year, GSI Summit (Lisbon) 2022 by Hitachi Vantara

New partnerships

With a view of strengthening its existing capabilities in key areas such as Data, Security, Customer Experience, and FinTech, LTIMindtree expanded its alliance portfolio by incubating partnerships with Alation, ThoughtSpot, Query Surge, SnapLogic, Redpoint, Treasure Data, Turbotic, WSO2, Cyfirma, TrustMAPP, Knowbe4, Everbridge, Workday, and Mambu. In addition, we have signed agreements with Google Cloud, Microsoft, and IBM for regional expansion as well as for partnering in new joint programs.

LTIMindtree’s partnership ecosystem is the cornerstone of its hypergrowth strategy. We will continue to collaborate with its partners and focus on developing joint Go-To-Market (GTM) strategies for market expansion and executing demand generation initiatives to drive incremental growth. LTIMindtree will also continue to co-invest in super-scaling existing technical expertise and building new capabilities with a view to be the preferred partner for jointly pursuing and winning industry-defining deals.

LTIMindtree is an Amazon Partner Network Premier Consulting Partner for Amazon Web Services (AWS). Our GTM strategy on AWS is a trifecta approach cutting across areas like Data & Analytics, and Migration & Application Modernization.

We have enabled large Data Center exits and assisted global enterprises in successfully migrating and modernizing their applications on the AWS cloud. Additionally, we have helped enterprises in migrating from traditional databases to modern AWS databases like AWS Aurora, uncovered business insights, and helped our customers monetize their data through our niche Data and Analytics IPs and Accelerators, built on the AWS cloud.

We are also focusing on next-gen technologies like IoT and AI/ML, leveraging the power of AWS cloud. During FY23, we scaled up our investments in ramping up the AWS COE and also launched a joint AWS Innovation Center in Hartford, Connecticut (US).

This collaboration, combined with the strength of LTIMindtree’s 10,200+ accredited cloud experts, enables us to provide AWS’s extended services to our client base in an effective and efficient manner. LTIMindtree was named AWS Migration Partner of the Year (NAMER) 2022 and AWS Global Collaboration Partner of the Year (2022) at the ‘AWS re:Invent’ event in Las Vegas in November 2022.

1,290+

AWS certified professionals with 25+ AWS accelerators

3-year

strategic collaboration agreement with AWS

9 Competencies

and 13 Service Validations

Amazon Lookout

for Vision Partner

AWS Immersion

Day Partner

LTIMindtree is a Global System Integrator and Premier Partner for Google Cloud Platform (GCP) and Google Workspace. Our GTM strategy with GCP comprises big bets in Data Lake Modernization, EDW Modernization, Modernize traditional Applications & Platforms, Mainframe Cloudification, and Security Operations. LTIMindtree has scaled up its investments to ramp up the ‘GCP COE’ and is investing in building IPs and Accelerators. Additionally, we have attained two Specializations (Application Development and Data Analytics), 37 Expertise, and have 460+ GCP certified associates. We are also a strategic vendor to Google’s ‘Professional Services Organization’ (PSO) providing Google Cloud customers with qualified partners that have demonstrated technical proficiency and proven success in specialized solution and service areas.

LTIMindtree has a long-standing 360 Degree Gold partnership with Microsoft and has significantly strengthened its Microsoft credentials by adding 11 new specializations, including SQL server migration to Azure, SAP on Azure, Kubernetes on Azure, analytics on Azure, and web application modernization on Azure and Windows.

It also received a solution partner designation in digital & app innovation, infrastructure, Data and AI, security, and modern work. With Microsoft, we have built a 3-year strategic plan to supersize joint business across the six Microsoft solution areas.

LTIMindtree is also a member of exclusive Microsoft programs including the Mixed Reality Partner Program (MRPP) and the Microsoft Security Solution Provider (MSSP). Our success with Microsoft is supported by more than 19,000 trained associates and 11,000 certified experts who help customers around the world solve complex business problems.

Azure

Expert MSP

11 advanced

specializations

5 Solution

Partner designations

Dedicated

Microsoft Business Unit

68+

solutions listed on the Azure marketplace including consulting services and transactable IPs

7 regions

CSP partner

Funding enabled

across geographies

LTIMindtree is IBM’s GSI and Platinum Business Partner with global coverage. Our long-standing strategic, strong alliance has grown multifold, seamlessly delivering for their joint global clients while leveraging robust IBM technologies.

In 2021, LTIMindtree partnered with IBM to open a first-of-its-kind ‘Innovation & Experience Center’ in Bengaluru. This center serves as a one-stop shop for customers to see joint best-in-class solutions built on IBM technologies to help them foster and accelerate their digital transformation journey.

Our GTM priorities with IBM include digital business automation, sustainability, hybrid cloud, and security. We have six Expert level IBM competencies in Digital Business Automation, Cloud Integration and Development, Assets and Operations, Cloud Management, Threat Management, and Digital Trust. The IBM Partner Solution Showcase portal now includes LTIMindtree’s joint offerings iDigitalization (iDz) and Digital Hybrid Infrastructure Platform (DHIP).

With 25+ years of experience, 200 global SAP customers, 9,000+ SAP Minds carrying 3,000+ certifications, and 50+ purpose-built SAP innovations, LTIMindtree has one of the industry’s largest and most mature SAP practices. LTIMindtree, one of SAP’s 19 Global Strategic Services Partners (GSSP), assists organizations in leveraging the latest SAP innovations such as RISE with SAP, S/4HANA Cloud (Private/Public), Industry Cloud Solutions, SAP Business Technology Platform (BTP) based Platform-as-a-Service (PaaS) offerings, sustainability, mid-market, and various other solutions. This has helped LTIMindtree win several SAP awards and recognitions, including the SAP Pinnacle Award for Industry Innovation, as well as an invitation to Sapphire 2023 as one of the nine global ‘Premier’ sponsors–a testament to LTIMindtree’s growing stature in the SAP market and its relationship with SAP.

For 20+ years, LTIMindtree has been a trusted partner of Oracle, enabling customers to leverage cloud technology for maximum ROI. As a Global Expertise and Cloud Solution Provider Expertise partner, we collaborate with Oracle on marketplace offerings, competency centers, and customer advisory boards. With more than 150 Oracle Expertise Badges and 3,500 Oracle-Certified Professionals, LTIMindtree has established itself as a top partner. We have been recognized with several Oracle awards, including the Global Best Commerce Cloud Transformation, the Global Earthfirst Award for Operational Excellence in Sustainability, the JD Edwards Product Innovation, and the Oracle Nordics Cloud Partner of the Year Award for OCI. LTIMindtree’s services include Oracle Cloud Application, Oracle Cloud Infrastructure, Enterprise Application, and Industry GBU Application. LTIMindtree’s expertise in Oracle Application Development, Digital Native Applications, Applications to Oracle Cloud, Database to Oracle Cloud, DevOps, Platform Integration, and Data Management makes it a leader in the field. Our Oracle solutions help modernize on-premise applications for improved business outcomes, while our Industry Cloud solutions offer hyper-personalized customer experiences. We have also developed joint GTMs with Oracle in multiple geographies.

LTIMindtree has established a strong partnership with Snowflake, earning the highly coveted Elite Partner status and being named one of Snowflake’s top three partners globally. Our 360-degree partnership, combined with differentiated offerings across the data modernization value chain, is a game changer in the industry. With 1,000+ Snowflake-trained and 250+ SnowPro-certified resources, we have the highest number of such advanced architects worldwide.

Our Snowflake deal wins are attributed to our highly acclaimed accelerator PolarSled. Delivering amplified outcomes for 60+ customers, our commitment to innovation and delivery excellence has been widely recognized, with Snowflake conferring on us the Innovation Partner of the Year (2021) and Delivery Platform Partner of the Year (2022) awards. We have also received industry badges for Manufacturing and Financial Services, demonstrating our expertise in these industry domains.

We are an Elite partner of ServiceNow. LTIMindtree’s strategic partnership with ServiceNow spans programs like Sales, Services, Service Provider and Technology Partner Program. Our Managed IT Services solution, designed in partnership with ServiceNow helps organizations get the speed and quality of IT services required to be on top of changing business needs.

LTIMindtree’s dedicated ServiceNow practice has carried out large-scale transformational engagements covering the entire value chain and ServiceNow offerings portfolio at some of the world’s largest media & entertainment and utilities & manufacturing companies. In addition to upskilling and reskilling resources across various ServiceNow certification streams and building competencies beyond ITSM, we have invested heavily in establishing a dedicated ServiceNow engineering team and COE, and are also developing a broad range of custom applications and accelerators to drive function-specific as well as enterprise ServiceNow solutions.

We inaugurated our first ever Innovation & Experience Center with ServiceNow in Hartford, USA in April 2022. In early 2023, LTIMindtree was awarded the Emerging Service Provider Americas award by ServiceNow to recognize our excellence in business innovation, product line expansion, scaling competency, and revenue growth.

Salesforce

LTIMindtree is an established premium consulting partner of Salesforce with 18+ years of experience on the platform. As a Summit (Platinum) Partner, we specialize in Salesforce/MuleSoft implementation strategies to drive digital growth through deep client engagement.

With 3,000+ certified consultants and experience of 3,000+ projects, we offer services across the Salesforce success value chain – ranging from Strategy Consulting & Solution Design to Implementation and Application Value Maintenance. Our practice and offerings are guided by dedicated COEs for Core services, Marketing, Commerce, Industry Clouds, and functional consulting.

Recognized by industry analysts including ISG, NelsonHall, Avasant, Forrester and Gartner, we provide transformational services across the Salesforce portfolio including but not limited to:

- Sales Cloud/Experience Cloud/CPQ

- Service Cloud/Field Service

- Marketing campaign ops and personalization

- B2C and B2B commerce clouds

- Industry clouds

- PaaS implementations based on Force.com platform.

LTIMindtree is a Global Platinum Solutions Partner for Adobe – the highest level of GSI partnership on offer. Our GTM focus areas cut across Data & Personalization, Omnichannel Commerce, and end-to- end content lifecycle.

LTIMindtree brings a full suite of customer experience transformation services to the table and has been an anchor partner for many of its large customers in their digital transformation programs. We strategize their digital marketing programs and build and maintain their digital marketing platforms.

The Adobe practice at LTIMindtree has 1,200+ people and 150+ certified experts, with specializations in AEM Sites and AEM Sites - Run & Operate. We are also rapidly scaling up investments in marketing operations and omnichannel commerce.

LTIMindtree was ranked by Everest as a ‘Major Contender’ in their annual PEAK matrix report for Adobe Service providers for 2022.

The LTIMindtree and Pega partnership strengthened significantly in FY23. The acquisition of Ruletronics, a pure-play Pega consulting and implementation player, helped scale our Pega credentials significantly. During the year, LTIMindtree was included by Pega in its exclusive list of Global Strategic partners. In addition to being a specialized and global reseller partner, we have achieved distinctions in Delivery Specialization (APAC, EMEA, and India) and Intelligent Automation Specialization in the Americas. LTIMindtree’s Pega practice is a 500+ team of strong and certified associates with expertise across Customer Service, Customer Engagement, and Intelligent Automation. With the Industry and Marketplace Solutions, Successful Customer Implementations, Certified skill set and joint GTM activities, LTIMindtree has earned a reputation as one of the most valuable and preferred partners for Pega.

LTIMindtree began its partnership with Boomi in 2020. In a short period of time, we have been elevated to a Global Gold GSI Partner with Boomi in September 2022. Our Integration practice and offerings on Boomi are guided by a dedicated Center of Excellence for Core services and Functional Consulting.

We offer our customers a complete spectrum of Integration services on Boomi that includes Implementation, Application Development, API-fication, COE setup, legacy migration and transformation. We have helped many of the Fortune 500 customers based in North

America with API-fication of various business critical e-commerce services, data integrations, and legacy integrations leveraging the Boomi AtomSphere platform to ensure seamless connectivity between integrations with multiple ERPs, Cloud Databases and CRMs.

LTIMindtree’s partnership with Hitachi Vantara as a Global System Integration Partner, helps clients harness the potential of digital technologies. Our GTM focus areas are along Storage-as-a-Service, VDI-as-a-Service, and Infrastructure-as-a-Service. We jointly offer consultative, advisory, implementation, and managed services. We leverage Hitachi EverFlex to offer the power to scale and flex as business demands change, and provide efficient pay-as-you- go offerings to keep IT costs aligned with business usage through powerful SLA guarantees.

Through this partnership, we enable our customers accelerate their digital transformation journey, offering proven scalable, secure, and cost-effective solutions for hybrid cloud.

LTIMindtree is a Cisco Gold Partner with a 360-degree relationship. Collaboration with Cisco enables us to provide next-generation IT solutions and services to our customers by leveraging various Cisco architectures. LTIMindtree leverages the Cisco partnership in initiatives for software-defined networking, data center transformation, application transformation security, unified communication, IoT, and smart city projects.

LTIMindtree has a large pool of Cisco-certified engineers and architects who work closely with our customers to deliver business outcomes. We have expertise in the design, implementation, support, and maintenance of Cisco architecture. LTIMindtree has also become a Meraki partner in other countries.

LTIMindtree is a Premier System Integrator partner of Duck Creek Technologies with 20+ years of experience on the platform. We specialize in Duck Creek solutions and services to help Insurance clients globally transform their business using modern core systems and digital innovation. Our differentiated solutions increase business agility, accelerate product rollouts, maximize operational efficiency, leverage cloud adoption, enhance customer experience, and deliver meaningful cost savings for Insurance carriers using the Duck Creek platform.

Our offerings are guided by dedicated COEs for Policy, Billing, Claims, Distribution, Reinsurance, Data Insights and industry standard best practices. Our team is the winner of the first Duck Creek Hatch-a-Thon challenge in 2022 and has since won multiple innovation awards from Duck Creek. We are the Product Engineering partner for Distribution. We are rated as a ‘Leader’ in the Duck Creek Services by independent industry analysts Everest in its 2022 PEAK assessment report. One new initiative is around a trifecta we are driving along with Duck Creek is where we partnered with Microsoft to build a solution that will enable insurers to migrate their on-premises core systems to the cloud in a quick and efficient manner.

LTIMindtree is a Global Services Partner of Temenos with 19+ years of experience on the platform. As a Global Delivery Partner, we specialize in Temenos-based transformation programs. Recognized by industry analysts including ISG, Forrester and Gartner, we provide transformation services across the Temenos portfolio including but not limited to:

- Temenos SaaS

- WeathSuite

- Transact Back Office

- Journey to Cloud

- Managed Services.

With 800+ certified consultants and an experience of undertaking 200+ projects, we offer services across the Temenos portfolio – ranging from strategy consulting and solution design to implementation and application Maintenance. Our practice and offerings are guided by dedicated COEs for Retail, Corporate, Wealth Implementations, Upgrades, Migration, Development, and Testing Consulting.

LTIMindtree has partnered with Rubrik Inc. since 2020 as one of the Top Global System Integration Partners providing cyber resilient data security solutions & services leveraging Rubrik for On-prem & Cloud environment. Through our partnership, we enable customers to move quickly away from existing backup and disaster recovery systems by offering an assessment, discovery, and migration with on-going management services, by backup and ransomware experts.

Rubrik and LTIMindtree have jointly built offerings and solutions like LTIMindtree Vault and LTIMindtree M365 protection to provide managed services for enterprise customers.

LTIMindtree, in collaboration with Rubrik, provides:

- Expert advisory, implementation, migration, and ongoing managed services

- Advanced automation, APIs and managed pilots to accelerate transformation program

- Zero Trust Data Protection with ransomware detection and immutable backups

- Managed ransomware investigation, incident containment, and sensitive data discovery

- Simple, rapid recovery: Near-instant restoration of critical apps and clean versions of data

Digital transformation as a means to serve the dual objective of driving revenues as well as cost-efficiencies is an ongoing business imperative. We are at a point where technology and experience transformation have become so integral to business strategies that it is not easy to reverse or stall digital transformation programs.

To cope with the fast pace of technology shifts, we foresee that, in the future, clients will need to continuously transform, both from inside-out and from outside-in. This will be across the facets of business model transformation, experience transformation, operations transformation, and technology ecosystem transformation. With our expanded, well- diversified offerings as a combined, at-scale entity, we believe we are well positioned to help businesses address their transformation objectives well.

Some of our strengths and focus areas include:

Cloud transformation

Our end-to-end cloud transformation solutions and services help organizations implement complex global scale transformation programs. It follows five fundamental dimensions:

- Purpose-led: Purposeful Cloud enabled by LTIMindtree’s North Star Framework

- Productized: Packaged service offerings across the lifecycle of cloud transformation

- Platform-enabled: Infinity, LTIMindtree’s cloud transformation platform, provides speed, scale, and consistency

- Partner-aligned: GTM and competency teams dedicated to partners – AWS, Azure, and GCP

- Rainmakers: Elite team of consultants bring a holistic approach for cloud journey

Experience design

LTIMindtree’s high-impact team of strategists, researchers, designers, and technologists constantly raise the bar with transformative solutions that engage customers and create immersive experiences. Our experience strategies are backed by user research, experience assessments and benchmarking, service blueprints, personas, and journey maps. We provide high-fidelity prototypes with testing and validation at our design factory.

Blockchain

LTIMindtree embraces a partnership-based approach with our customers at the outset of their blockchain journey. We have a Blockchain Maturity Model (BMM) that consists of four levels to develop and deliver quick prototypes and then scale and evangelize to the production stage.

- Consulting excellence: Our blockchain consulting team offers customized services ranging from use case identification, technical due diligence, and ROI roadmaps, etc.

- Engineering and platform excellence: Our blockchain accelerators - Automation Platform and Smart Contract Factory can be leveraged by clients to prototype and realize ROI faster.

- Open-source excellence: Our blockchain-certified team participates in several open-source projects which enables them to deliver products using best practices.

- Delivery excellence: Our E&P and delivery teams with experience of executing projects in multiple industries assure a seamless delivery experience.

Applied AI

AI is being embedded across products and processes rapidly. However, the point of contention comes while moving the needle from experimentation to scaling AI, as most fail at this point. LTIMindtree’s KenAI addresses the core challenges of scaling, managing, and governing the models on cloud data platforms. KenAI provides powerful automation and lifecycle management to simplify and accelerate operationalizing and managing AI models. It helps deliver simplified machine-learning operations leveraging automation, predictability, and responsible AI.

Digital engineering

With engineering embedded in our DNA, and a strong culture of design, we help deliver a reimagined customer experience with faster time-to-market. We harness modern digital capabilities to envision the right digital products and solutions for transforming end-user experiences. We have a three-pronged approach to deliver experience at speed:

- Craft: Solid structure, cross-skilled talent, and niche engineering-based culture to harness modern digital capabilities

- Science: Innovation driven by converging technology COEs, nurtured by in-house Digital Engineering Academy.

- Art: Bringing craft and science together to reimagine digital for our clients, optimizing operations, and digitizing their core.

Enterprise applications

LTIMindtree has one of the industry’s most mature SAP practices. Over 25 years, we have partnered in some of the world’s largest and most complex SAP estates. Our real-life practitioner’s perspective allows us to build purposeful digital solutions that drive businesses forward. With 50 industry-leading innovations on SAP platform and our Reimagination Studio, we accelerate S/4HANA and cloud-enabled transformations for enterprises. LTIMindtree has also built a two- decade long partnership with Oracle to maximize value for customers. Powered by LTIMindtree Enclose and Infinity, we bring together a perfect blend of industry domain, functional, and digital capabilities powered by Oracle cloud to solve real-world customer problems. As an established Salesforce consulting partner, we have worked in strategic partnership with Salesforce since 2004, shaping platform evolutions and innovations in all clouds.

LTIMindtree was formed in November 2022 following the merger of two very successful companies, L&T Infotech and Mindtree, both part of the Larsen & Toubro Group. It is a new kind of technology consulting firm helping businesses transform – from core to experience – to thrive in the marketplace of the future. With a unique blend of engineering DNA and experience DNA, LTIMindtree helps businesses get to the future, faster.

The strategic objectives of the merger includes:

- Becoming an at-scale service provider, well-placed to capture market share in today’s dynamic business environment. LTIMindtree is now the fifth-largest Indian IT services provider by market capitalization and the sixth largest by revenue

- Ability to engage even more meaningfully with the partner base, to create fit-for-purpose solutions for clients

- Enhance mindshare with the analyst and advisor base

- Leverage a highly complementary industry/client base. The combined entity services nearly a fifth of the Fortune 500 clients (95 of 500), and there is significant opportunity to cross-sell and up-sell across the client base

- Expanded set of capabilities that help us serve client needs end-to-end, from core to edge to experience

- Increased ability to shape and win large, transformational deals by virtue of our scale and end-to-end offerings

- Access to a larger and more diverse talent base, and the ability to engage our talent more meaningfully

- Robust balance sheet to enable targeted investments into growth and capability building.

The intent to merge was announced in May 2022 and the effective date for the Company to operate as a merged entity was November 14, 2022. A merger of this scale comes with its share of challenges, requiring the management of sentiments and processes across the stakeholder ecosystem and business landscape. The process has been facilitated by the existing familiarity and collaboration between the two companies, as they had previously engaged in joint pursuits of various deals even before the merger took place. This, along with the oversight of the same parent Group, enabled us to complete the merger in record time.

Although LTIMindtree began operations only in the middle of Q3 FY23, we are encouraged by early indications that the merger rationale is playing out as expected. Looking ahead, our focus continues to be to deliver best-in-class services to our clients leveraging our deep industry domain and technology expertise, while exploiting the synergies provided by the merger. Our focus has also been on making available to our leadership and employees the vast opportunities that exist as part of a fast-growing organization.

As we go through FY24, we aim to simplify, unify, and provide clarity to our clients, our employees, and our stakeholders (partners, analysts, investors, etc.) to help them to get to the future, faster, together.

We propose to do this through our LTIMOne framework comprising the following pillars:

One culture

- A common purpose and vision

- Our work ethos: Be driven by purpose; Act with compassion; Be future-ready; Deliver impact.

One Go-to-Market (GTM) strategy

To help our clients continuously transform, both inside-out and outside-in, via:

- Business model transformation

- Experience transformation

- Operations transformation

- Technology ecosystem transformation.

One unified capability

To build unified capabilities by amplifying our strengths, enabling synergies, and developing a compelling integrated proposition to our clients. We will accomplish this by:

- Pioneering a bold, new organization design to create a cohesive capability flywheel

- Force multiplying through collaboration with leading partners

- Strengthening our large practices while nurturing new growth engines, and

- Leveraging our best-in-class IP to deliver non-linear outcomes.

One profitable growth model

While we continue to focus on capabilities and growth, we will also ensure we drive sustainable value creation through four levers:

- Consistent profitable growth

- Cost synergies, along with disciplined execution

- Capital allocation framework to support rapid growth

- Creating shared value for our stakeholders and the communities we operate in.

As cloud, data, and digital become critical for every organization, our vision is to enable businesses to stay competitive in their technology transformation journeys and get them to future, faster. We possess the resources, scale, and confidence of a leader along with the energy, hunger, and ambition of a challenger. To this end, we are pleased with the conversations we are having with clients across markets and, in several instances, we are able to bid for deals that the erstwhile organizations individually would not have been able to, and our increased scale has also started paving the way for our elevation to a Tier-I partner with existing clients.

The services market continues to be volatile, with the unfolding geopolitical and macroeconomic scenario inducing caution in technology spending amongst businesses. However, we strongly believe that the structural story of the IT industry is intact for the long-term and, specifically, the opportunities ahead of LTIMindtree are immense, which we aim to capitalize on.

Cost control is an important business priority for us. We consistently explore ways to optimize our overall cost. During the year, we have implemented various programs towards bending the cost curve which include:

- Robust resource planning to avoid any cost leakage

- Higher intake of freshers and right-shoring to optimize cost per resource

- Optimization of subcontractor cost

- Cutting down on discretionary spends.

An overview of the consolidated financial results for FY23 and FY22 is given below:

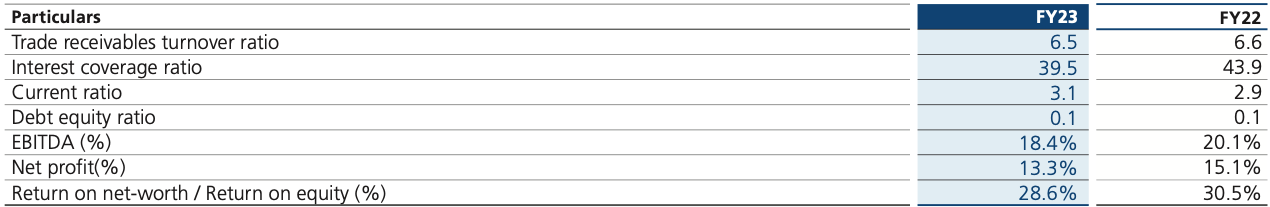

Return on net-worth reduced on account of lower Profit After Taxes (PAT) margin for FY23 and increased capital base.

Income

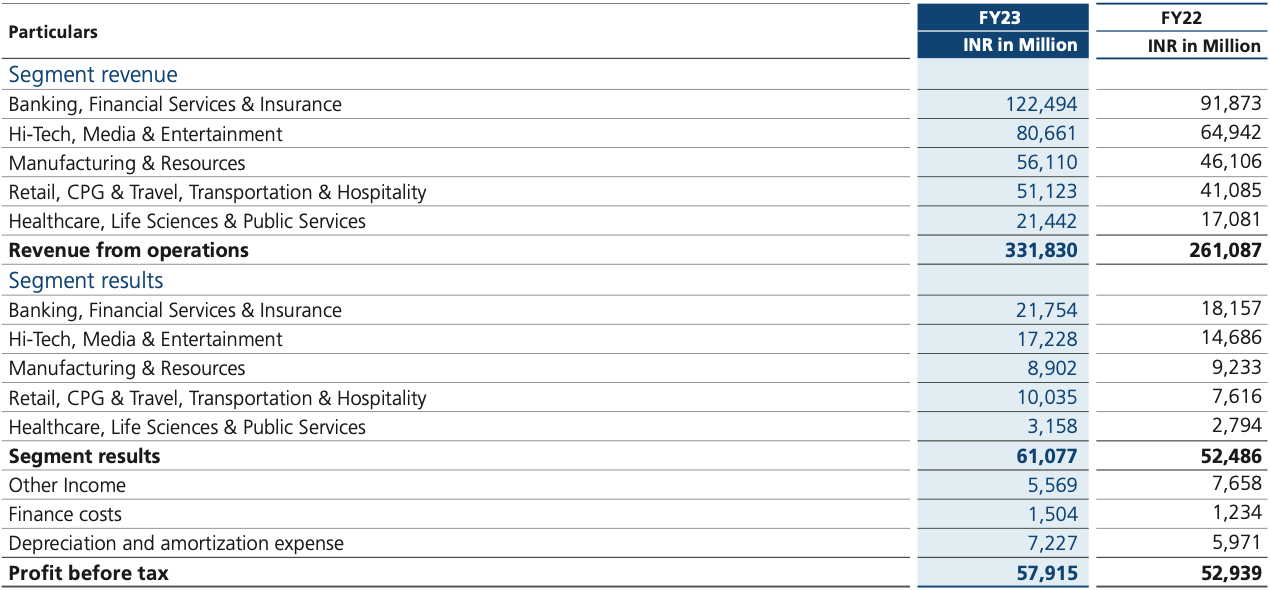

USD revenue for FY23 increased 17.2% to USD 4,105.7 Million, while INR revenue rose 27.1% to INR 331,830 Million.

We analyze our revenue (in USD terms) based on various parameters

- Revenue by vertical: Banking, Financial Services & Insurance grew by 23.0%; Hi-Tech, Media and Entertainment by 14.5%; Healthcare, Life Sciences & Public Services by 16.4%; Manufacturing & Resources by 12.1%; and Retail, CPG, Travel, Transportation & Hospitality by 14.8%.

- Revenue by geography: Banking, North America grew by 21.5%, Europe by 3.9%, and Rest of the World by 12.2%.

The number of active customers, as on March 31, 2023, was at 728, up from 673, as on March 31, 2022. The number of USD 50+ Million clients increased to 13 from 10.

Other income in FY23 has increased to INR 4,544 Million from INR 3,274 Million in FY22, primarily due to increase in interest income on investments by INR 499 Million (return on investment increased by 90bps to 5.6% in FY23 from 4.7% in FY22), and write back of contingent consideration relating to past acquisitions INR 638 Million.

Foreign exchange gain for FY23 was INR 1,025 Million as against a gain of INR 4,384 Million in FY22, majorly due to loss on cashflow hedges reclassified to profit and loss.

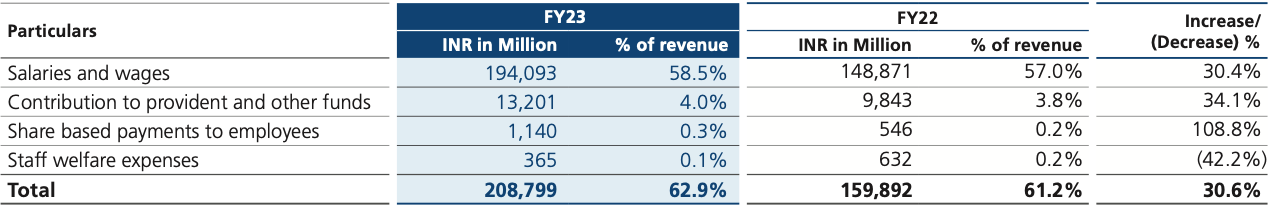

Employee benefits expense

Employee benefits expense account for 62.9% of our total revenue and form a major part of our total expenses. The expenses include fixed as well as variable components of employee salaries, along with contribution to provident fund and gratuity. Share-based payments to employees and staff welfare expenses are also part of that cost.

Total employee benefits expense increased by 30.6%. As a percentage of revenue, employee benefits expense increased to 62.9% in FY23 from 61.2% in FY22. Increase in salaries and wages, and contribution to provident and other funds, were in line with the increase in revenue and headcount, including increments and promotions. The increase in share-based payments was due to new grants made during FY23.

Sub-contracting expenses increased to INR 28,286 Million in FY23 from INR 23,591 Million in FY22, on account of an increase in subcontractor rates, headcount, and foreign exchange impact.

Other expenses comprise all other incidental costs, apart from employee benefits costs like travel, rent, cost of equipment, and hardware and software packages.

Break-up of other expenses

Other expenses, as a percentage of revenue, increased by 0.5%. Other expenses increased by 34.0% year on year, mainly due to an increase in travel expenses, cost of equipment, hardware and software packages, rates and taxes, and one-time merger and integration related expenses.

Profitability and margins

- PAT growth in absolute terms is at 11.7% and PAT % for FY23 is 13.3% compared to 15.1% for FY22.

- EBITDA growth in absolute terms is at 16.4% and EBITDA % for FY23 is 18.4% compared to 20.1% for FY22.

- EBIT growth in absolute terms is at 15.8% and EBIT % for FY23 is 16.2% compared to 17.8% for FY22.

- Effective tax rate was at 23.8% in FY23, compared to 25.4% in FY22.

Segment reporting

Segments have been identified in accordance with the Indian Accounting Standards (Ind AS) 108 on Operating Segments, considering the risk or return profiles of the business. As required under Ind AS 108, the Chief Operating Decision Maker (CODM) evaluates the performance and allocates resources based on analysis of various performance indicators. Accordingly, information is presented for the Company’s operating segments.

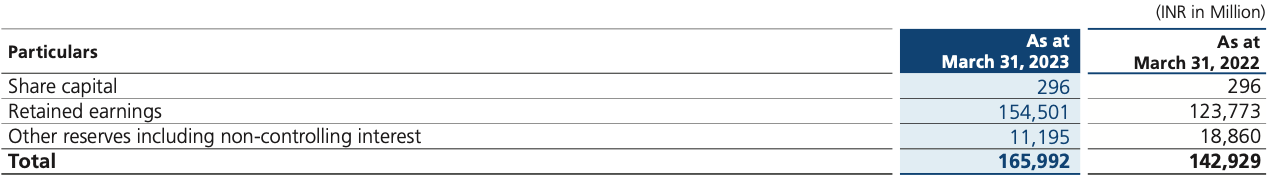

Total Equity

Other equity increased by INR 23,063 Million, primarily due to the following movements:

- Retained earnings increased by INR 30,728 Million from INR 123,773 Million to INR 154,501 Million, mainly due to current year profit of INR 44,103 Million, which is offset by dividend recognized of INR 15,627 Million.

- The loss arising from change in the effective portion of cash flow hedge (changes in the fair value of the derivative hedging instrument designated as a cash flow hedge) amounted to INR 6,951 Million

- Increase in share premium of INR 336 Million on account of allotment of shares pursuant to ESOPs.

- Balance in share options outstanding reserve increased by INR 784 Million, on account of compensation cost related to employee share-based payment.

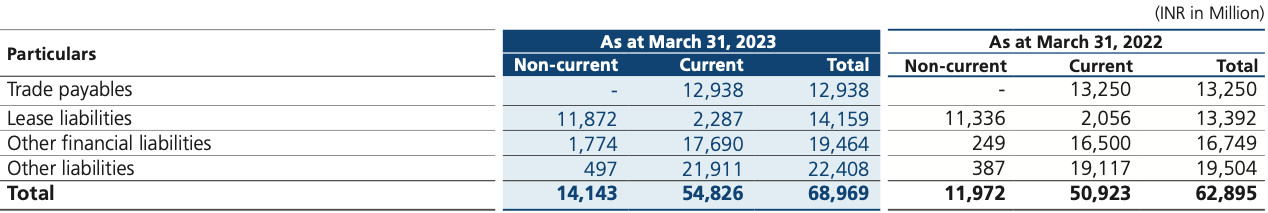

Liabilities

- Non-current liabilities increased by INR 2,171 Million primarily due to increase in forward contracts payable of INR 1,590 Million and increase in lease liabilities by INR 536 Million.

- Current liabilities increased by INR 3,903 Million mainly due to an increase in salary and other expenses in line with business. Key components include increase in forward contracts payable by INR 1,802 Million, increase in provision for compensated absences by INR 1,714 Million, increase in statutory dues by INR 734 Million and increase in borrowings by INR 734 Million offset by reduction in acquisitions related payables by INR 1,986 Million.

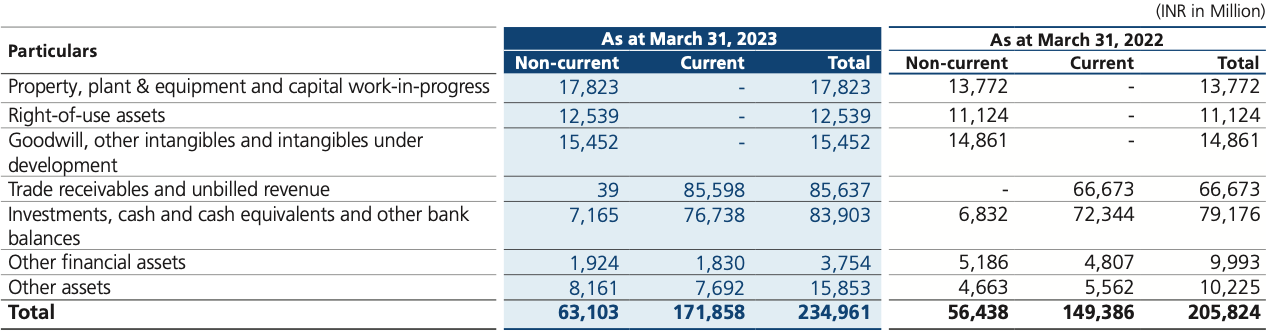

Assets

- Our capital work-in-progress increased by INR 3,537 Million from INR 4,589 Million as on March 31, 2022 to INR 8,126 Million as on March 31, 2023 mainly attributable to construction of premises at Mahape.

- Deferred tax assets increased by INR 3,422 Million from INR 387 Million as on March 31, 2022 to INR 3,809 Million as on March 31, 2023 mainly attributable to the creation of deferred tax asset on marked-to-market valuation loss arising on hedges.

- Our trade receivables and unbilled revenue increased by INR 18,964 Million from INR 66,673 Million as on March 31, 2022 to INR 85,637 Million as on March 31, 2023 in line with the increase in revenue. Days Sales Outstanding (DSO) (billed and unbilled) increased from 90 days as on March 31, 2022 to 91 days as on March 31, 2023.

- Our cash and investments increased by INR 4,727 Million from INR 79,176 Million as on March 31, 2022 to INR 83,903 Million as on March 31, 2023 mainly due to cash generated from operations of INR 30,946 Million offset by dividend payout of INR 15,627 Million, purchase of property, plant and equipment of INR 9,393 Million, and payment of lease liabilities of INR 3,388 Million.

Employee Value Proposition

LTIMindtree offers a comprehensive Employee Value Proposition (EVP) that caters to their diverse needs. The EVP is structured around four key pillars: Talent-growth Opportunities, People-centric Culture, Rich Employee Experience, and a Compelling Brand. We provide ample opportunities for career growth and development through our global presence and career framework. LTIMindtree’s people-centric culture is driven by employee-friendly policies, flexible work arrangements, and a performance-driven approach. Our rich employee experience includes recognition programs, wellness-focused initiatives, and diversity and inclusion practices. As a top-tier organization with compelling brand and strong financials, we attract, retain, and engage top talent in the industry. Prioritizing these pillars results in a highly engaged and productive workforce that drives growth and success of the organization.

People strategy for merger of LTIMindtree

LTIMindtree’s merger initiative was a well-executed process that harmonized HR processes, systems, and policies to create a cohesive organization. The HR team developed a common culture, harmonized policies across 35 countries, and synchronized 200+ programs, processes, and systems while ensuring no disruption to employees’ day-to-day functioning. A well-oiled Change Management governance ensured proper implementation, including various communication channels and training sessions conducted across the globe. Our people-first approach ensured a smooth transition for employees, and we are now well-positioned for continued success.

Talent Acquisition

LTIMindtree has hired 28,905 lateral employees globally, with a focus on diversity and inclusion, including a 30% female workforce. We have enhanced our hiring process with technology and a Buddy Referral program. The LTIMindtree Campus Hiring program recruited 5,196 candidates from universities worldwide, supported by 162 partnerships and 600+ engagement events.

The Leadership Hiring team at LTIMindtree focuses on diversity and inclusion, engaging senior professionals, and creating a passive hiring pool and talent map for critical roles. The GEMS program assesses leadership needs, selecting qualified, diverse leaders for a healthy talent pipeline. The Onboarding program provides new hires with a 30-day incubation period, consistently receiving an average experience rating of 94%, with 90% participation in the induction experience survey. The Onboarding team nurtures new joiners with one-to-one support, constant group connects, 30-day open forum, and periodical checks over surveys.

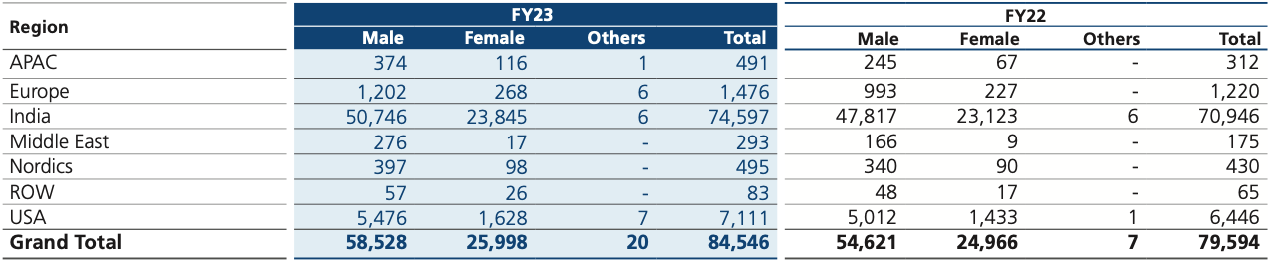

Diversity, Equity, and Inclusion

LTIMindtree is committed to diversity, equity, and inclusion (DEI) in its workforce. We also have self-identified PWD, LGBTQ+ and veteran employees as part of our voluntary DEI disclosures. We believe that diverse and inclusive teams enhance productivity, problem-solving abilities, innovation, financial performance, resilience, and employee engagement.

To promote a culture of inclusion, we focus on creating a psychologically safe space where respect, belongingness, empowerment, and progress are promoted for all. We have implemented several initiatives and programs to foster DEI in the workforce, workplace, and the world. These initiatives include DEI training for new joiners, inclusive policies and benefits, diverse hiring strategies, and learning and sensitization modules on diversity, equity, and inclusion. Additionally, LTIMindtree has specific DEI programs, such as Women Tech-Trailblazer, Womb to World, and initiatives for unconscious bias, women in data and analytics, and inclusive management training.

We have received several awards for our DEI initiatives and programs, including the Economic Times award for ‘Best Organizations for Women 2023’, DivHERsity Awards, and ‘Best Firm for Women in Tech’ by Analytics India Magazine. These awards testify our commitment towards promoting diversity, equity, and inclusion in our workforce. We aim to create an inclusive environment where everyone feels a sense of belonging.

Employee Engagement and Wellness

We prioritize employee engagement and wellness by implementing various initiatives and services. In terms of engagement, we empower women, organize employee connects and leadership touchpoints, and implement the GEMS program to create a diverse talent pipeline. We also collaborate with universities to engage employees. These initiatives not only improve employee satisfaction but also contribute to the organization’s growth and success.

LTIMindtree’s Wellness framework focuses on four pillars: Emotional, Physical, Financial, and Social, with various initiatives under each pillar to support employees’ holistic well-being. We offer counseling services, 24/7 medical assistance, elder care services, and a Will & Legacy Planning communication campaign. The Wellness program aims to develop a respectful culture, provide competent and supportive leadership, and encourage a balanced life, safe work practices, and increase employee involvement.

Career progress and growth

The 7-step program is a blended learning model that prepares professionals for enterprise-level roles by strengthening their competencies. The program has benefited 2,602 employees, with 1,000+ employees being certified, and 38,000+ learning hours recorded.

Talent Central is an AI-based platform that identifies skill gaps and recommends appropriate training. It maps the current talent pool with future technology, ensuring the organization stays innovative and competitive. Diversity, Equity and Inclusion are the core components.

The Shoshin School provides 5,000+ courses curated by subject matter experts, covering technical, functional, behavioral, and leadership skill development. It offers personalized and customized learning experiences for employees through predictive analytics. More than 80,000 employees benefited from it, and in FY23, 5.1 Million+ learning hours were consumed.

My Career My Growth emphasizes the growth trajectory of employees, capability building, talent development, and retention. It focuses on future-proofing the organization by providing talent analytics to all key stakeholders.

Our succession planning strategy is designed towards creating a global leadership pipeline by identifying and developing potential employees for future leadership roles in the organization. It enables managers to guide their team members, track their progress, and internally develop succession candidates through the Career Development tool.

LTIMindtree has begun a digital transformation of its employee experience by digitizing the employee lifecycle. We have chosen a SaaS platform to power the entire employee journey, from hiring to retirement, with intelligent workflows. Our alumni, exit management, and grievance redressal processes have been automated.

LTIMindtree’s Rewards and Recognition (R&R) program is designed to recognize and reward employees and teams globally for their outstanding performance, with a focus on our four core values. The program is divided into four broad categories: Continuous, Individual, Team, and Org-wide. At an overall level, our R&R program aims to boost employee morale, engagement, and productivity, creating a positive and competitive workplace where employees can learn, grow, and celebrate together.

Internal control systems

We have an Internal Control System commensurate with the size, scale and complexity of our operations. Process has been set up for periodically apprising the senior management and the Audit Committee of the Board about internal audit observations of the Company with respect to internal controls and status of statutory compliances.

Business heads and support function heads are responsible for establishing effective internal controls within their respective functions. Standard operating procedures and internal control manuals are defined and continuously updated.

The Company has laid down internal financial controls as detailed in the Companies Act, 2013. These have been established across the levels and are designed to ensure compliance to internal control requirements, regulatory compliance and appropriate recording of financial and operational information.

The internal audit team periodically conducts audits across the Company, which include review of operating effectiveness of internal controls. The Company, wherever necessary, engages third party consultants for specific audits or reviews.

The Audit Committee oversees internal audit function.

Threats, Risks and Concerns

We are exposed to a wide variety of connected and interconnected risks. To ensure suitable risk prioritization and mitigation, we identify the internal and external events that may affect our strategies and potentially impact our results, capital, and reputation. Enterprise Risk Management (ERM) enables the management to efficiently deal with uncertainty and the associated risks and opportunities, along with enhancing the capacity to build shareholder value.

A class action lawsuit was filed in the southern district of New York in US against the Company alleging discrimination by an ex-employee and an ex-contractor. The parties have arrived at a settlement through mediation. A preliminary fairness order of settlement has been approved by the court in the matter.

During FY20, the US Department of Justice and US Immigration and Customs Enforcement initiated an investigation of the Company related to its use of US non-immigrant visas for its employees. Pursuant to the same, the Company has provided the requested details to the authorities.

US District Attorney’s office has confirmed that there is no intention on their part to pursue any investigation or any claim against LTIMindtree Limited to immigration, and the matters stand closed.

Outlook

Our end-to-end services portfolio, comprehensive capabilities, strong sales engine, proven account mining, and healthy balance sheet position us well to continue delivering industry-leading profitable growth. Our unique position as LTIMindtree provides us opportunities to bend the cost curve through various levers, steer efficiencies in operational transformation, and drive incremental revenue with less impact on SG&A cost which coupled with cross-sell/up-sell opportunities will lead to an uptick in EBIT margin by 200 bps over the next four years from the historical 17-18% range. With accelerating growth, we continue to invest in our innovation, new growth engines, and platform-led delivery, and invest to expand through organic and inorganic growth to get access to new capabilities and geographies. We remain committed to delivering historical returns to shareholders and aim to achieve an ROCE of 40%+ and create shared value for all our stakeholders.

Our aim is to simplify, unify, and provide clarity to our clients, employees, and other stakeholders to get to the future faster, together, with our LTIMOne framework.

Forward-looking statement

Readers are cautioned that this discussion contains forward-looking statements that involve risks and uncertainties. When used in this discussion, the words ‘anticipate’, ‘believe’, ‘estimate’, ‘intend’, ‘will’ and ‘expect’ and other similar expressions as they relate to the Company or its business are intended to identify such forward looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events, or otherwise. Actual results, performances or achievements could differ materially from those expressed or implied in such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of their dates. The above discussion and analysis should be read in conjunction with the Company’s financial statements included in this report and the notes thereto. Investors are also requested to note that this discussion is based on the consolidated financial results of the Company.

Safe harbor

Certain statements in this release concerning our future growth prospects are forward-looking statements, which involve a number of risks and uncertainties that could cause our actual results to differ materially from those in such forward-looking statements. The conditions caused by the COVID-19 pandemic could impact customers’ technology spending, affecting demand for our services, delaying prospective customers’ purchasing decisions, and impacting our ability to provide on-site consulting services; all of which could adversely affect our future revenue, margin, and overall financial performance. Our operations may also be negatively affected by a range of external factors related to the COVID-19 pandemic that are not within our control. We do not undertake to update any forward-looking statement that may be made from time to time by us or on our behalf.