Digitalization in Auto & Auto-finance Market in North America

There was a time when Ford said, ‘A customer can have a car painted in any color as long as it’s black.’ We have come a long way to have a car which will park itself, and eventually start driving itself. In 2017, 275 different car models were offered. The changes are not limited to only the car’s make and model. In automobile financing as well, the US citizens have started witnessing as many varieties as the car’s models. Startups are instrumental in bringing a plethora of offerings for customers willing to buy an automobile in the US.

Challenges and Opportunities in Auto-finance

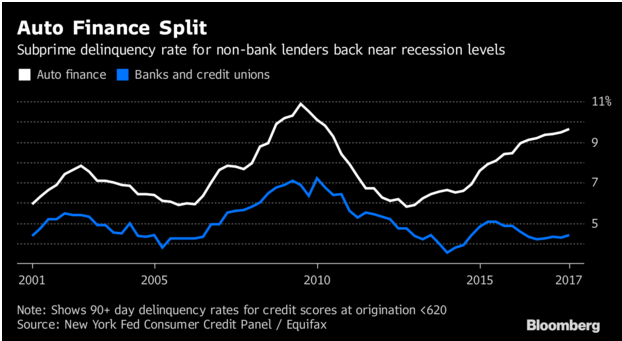

Amidst rising default and tenure of subprime auto loans, major banks are pulling out of the market. Auto loan delinquencies ratios are back near the recession levels of 2008. Below chart by Bloomberg explains the pattern.

Auto-finance companies use SAW (Stability, Ability and Willingness) framework to analyze the borrower’s creditworthiness. There are forty-two data points used to measure stability and ability of the borrower, but apparently, there was no way to measure the willingness to repay. The lender had to rely on past repayment behaviour for this measure, but that would leave out users who don’t have any credit history.

Today, startups are coming with a way to measure willingness to repay the debt using cognitive, predictive or social media analytics. Machine learning is changing the way risk was predicted.

Where is the Automobile Industry headed?

The ever-changing Automobile Technology is tempting millennials to change their vehicle every few years. Considering this trend, automobile companies and a few startups in the US have started giving out cars on a lease, which involves predefined monthly payments. For example, Porsche is offering subscription in which user will have access to its 22 models for unlimited mileage.

Most of the potential automobile buyers in the US use digital devices like Mobile, tablets and Laptops. They prefer searching for automobile features and financing online. They even go for online purchase and home delivery of the vehicle. Hence, the concept of dealerships is now changing to showrooms only. There are some companies offering concierge service which takes the car to customer’s doorsteps for trial and even offer on-the-spot financing options. Tesla started the trend of showrooms instead of the dealership, which is now getting popular in Europe as well.

Innovations in Automobile Finance

Auto finance companies in the US are working on three fronts to bring innovation – Enhancing customer experience, optimizing operational efficiency through digitization, and building the new business model. More on this below:

1. Millennials today prefer to browse and buy; hence few companies are focusing more on the mobile presence, and they are working to provide all vehicle information and instantaneous auto loans on click of a few buttons. Some of them are providing consultancy to customers to choose from numerous available options.

2. Earlier for a car rental customer had to fill in the personal details, which then would be sent to hundreds of dealers to generate a lead. A startup called Honcker has reversed this process by first gathering the special lease deals offered by nearby dealers. This process enables users to complete the rental process on their mobile within minutes.

3. Indirect financing at the dealership is one of the major ways of availing finances. A startup like Divido is offering open APIs for sellers to provide their customer financing options. Currently, almost all car dealership’s indirect finances are backed by their auto company’s finance subsidiaries. These subsidiaries usually don’t finance used cars. This segment is being targeted by new entrants.

New entrants in this space are posing challenges to the incumbents, as they are bringing innovations in the industry. Although the forecast says more than 17 million units of the automobile will be sold in 2018, there isn’t enough space for so many players.

So, what should Automobile Finance companies do to stay ahead of the curve?

Even a toddler can tell that digital first should be the way forward. More than that, the companies need to adapt to use technologies like biometrics, e-contracts, machine learning for improving operational efficiency and customer experience.

Incumbents in the market need to break some eggs to beat the innovations brought in by the auto-fintech startups, and these startups need to focus on getting a good return on investment by leveraging their agility. The startups have huge investment money versus the incumbents, who have better access to customer base through their dealerships.

Moreover, both can deliver better if they collaborate. For instance, Ford Motor Credit Company conducted a study with a fintech startup Zest Finance to measure the effectiveness of machine learning to better predict risk. General Motor’s Ally financial announced strategic alliance with a startup called ‘Fair’, which allows the customer to purchase a car based on pre-qualified EMI, and gives them the flexibility to walk away from the car with few weeks’ notices. Open auto-financing should be the way forward. Companies will have to proactively take actions to ride the wave of technological innovation. They say, ‘Businesses like an automobile & automobile finance have to be ‘Driven’, to get results’.

Latest Blogs

Introduction There is a lot of noise around Agentic AI right now. Every headline seems to…

Traditionally operations used to be about keeping the lights on. Today, it is about enabling…

Generative AI (Gen AI) is driving a monumental transformation in the automotive manufacturing…

Organizations are seeking ways to modernize data pipelines for better scalability, compliance,…